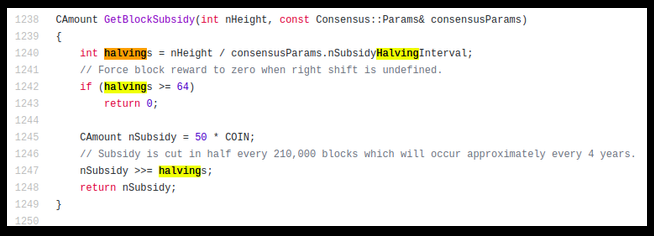

In 2017, JPMorgan CEO Jamie Dimon called Bitcoin a ‘fraud’ and threatened to fire all employees who were trading it. Yesterday JPMorgan added two bitcoin exchanges – Coinbase and Gemini as their corporate banking customers. They would help these two exchanges to manage the cash in the US. It is good news for the crypto industry. Let’s come back to the title topic of the post. The third bitcoin halving happened on 11th May, 2020. I got calls from some of my friends. They wanted to understand the halving thing! No, one bitcoin didn’t become ½ bitcoin. Bitcoin block mining reward got reduced from 12.5 BTC to 6.25 BTC. This was the third bitcoin halving in the history and it took place at the block height of 630,000. The first halving happened on 29th November, 2012 and the second halving took place on 10th July, 2016. Generally halving schedule is 4 years. In every halving event, bitcoin’s inflation or supply rate gets reduced. After the latest halving, bitcoin’s inflation drops from the previous rate of 3.6% to 1.7%. Okay cool! 1.7% is quite low. Bitcoin’s inflation rate is almost comparable to gold’s inflation now. But what happens to the miners?