Every crypto user will agree that Bitcoin mixers are some of the essential tools today. Unless you have no interest in protecting your digital assets, you probably use a bitcoin mixer while making transactions.

Bitcoin’s third halving happened a few days back. Bitcoin block mining reward got reduced from 12.5 BTC to 6.25 BTC. Bitcoin’s transaction fees are already high and with the inflation reduction, the mining fee to process the transactions may go higher only. Many layer 2 Bitcoin scaling projects are coming up nowadays to solve Bitcoin’s transaction speed & transaction fee issue. Lightning network is such a layer 2 technology for Bitcoin to scale up the blockchain’s capability by the use of micropayments. By taking the transactions away from the mainchain, lightning network targets to decongest the Bitcoin network and provide instant transactions with nominal fees. But there have been issues with lightning network as it is vulnerable to hacking. Lightning network didn’t find much use also after raising initial expectation.

If you don’t believe markets should be regulated then, if you trade or invest in crypto for a year or two, you soon will. While the financial press has always been flooded with histories of dodgy dealings in finance, many of the old scams have long since been driven out of the mainstream system. They are however alive and well in crypto.

I came to know about aelf in 2017 when they raised 25 million dollars through private finance. The project caught investor attention very early and it got listed in Binance too. aelf aims to create a decentralized cloud computing blockchain network to serve corporates. aelf launched their testnet in June, 2018 successfully and it can handle whopping 15,000 TPS.

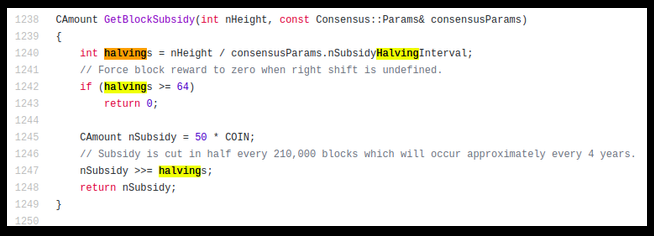

In 2017, JPMorgan CEO Jamie Dimon called Bitcoin a ‘fraud’ and threatened to fire all employees who were trading it. Yesterday JPMorgan added two bitcoin exchanges – Coinbase and Gemini as their corporate banking customers. They would help these two exchanges to manage the cash in the US. It is good news for the crypto industry. Let’s come back to the title topic of the post. The third bitcoin halving happened on 11th May, 2020. I got calls from some of my friends. They wanted to understand the halving thing! No, one bitcoin didn’t become ½ bitcoin. Bitcoin block mining reward got reduced from 12.5 BTC to 6.25 BTC. This was the third bitcoin halving in the history and it took place at the block height of 630,000. The first halving happened on 29th November, 2012 and the second halving took place on 10th July, 2016. Generally halving schedule is 4 years. In every halving event, bitcoin’s inflation or supply rate gets reduced. After the latest halving, bitcoin’s inflation drops from the previous rate of 3.6% to 1.7%. Okay cool! 1.7% is quite low. Bitcoin’s inflation rate is almost comparable to gold’s inflation now. But what happens to the miners?

New York-based cryptocurrency exchange Gemini, owned by the Winklevoss twins, is taking steps towards a more global reach, as suggested by Cameron Winklevoss, who was speaking at the ongoing Consensus: Distributed conference on May 11.

Soon… very soon! You can already see it all over the internet! Even on national TV! The Halving is near us. Many people inside the crypto space are newcomers, investors that bought the top and have been buying ever since, many still have their halving virginity… I do! And I guess in a few days I’m going to lose it! It’s exciting!